amazon flex take out taxes

Asked October 10 2017. Self-employed individualslike Amazon FlexFBA workerscan deduct their.

Delivering For Amazon Flex Requirements Driver Pay Work Overview 2022 Review Ridesharing Driver

Amazon Flex does not take out taxes.

. Amazon will issue a 1099 to Flex Drivers. No You are an Independent Contractor. I made a pretty good amount from when I started last year.

As a self-employed independent contractor you will have to pay taxes and self-employment tax on your. Amazon Flex drivers are self-employed. Tracking your mileage and expenses is the key to saving on taxesaka.

In todays video I wanted to share with you guys how to file a tax return if you are self-employed. Youre suppose to pay quarterly which I. Driving for Amazon flex can be a good way to earn supplemental income.

Amazon Flex quartly tax payments Self Employment tax Scheduled SE is generated if a person has 400 or more of net profit from self-employment on Schedule C. From there it is the. Or download the Amazon Flex app.

This is the non-employee compensation 1099 form you receive from Amazon Flex if you earn at least 600 with them if it is under 600 you will not receive the form -- but. Click the Amazon Flex app. As an Amazon Flex DoorDash Uber Eats Grubh.

Frequently Asked Questions - US Amazon Flex. Gig Economy Masters Course. This is your business income on which you owe taxes.

Does Amazon Flex take out federal and state taxes. Go to Settings Battery. Knowing your tax write-offs can be a good way to keep that income in your pocket.

No matter what your goal is Amazon Flex helps you get there. I did flex full time in 2017 made about 30k and after deductions Ill owe around 27k. Beyond just mileage or car.

Answered December 24 2017. You can ask Amazon for your 1099. If you participate in Amazon Flex or have participated in a similar program you can request a copy of your 1099 from Amazon.

They are responsible for paying their taxes at the end the tax year. Disable the settings for Freeze when in background and Automatically optimize. Increase Your Earnings.

In your example you made 10000 on your 1099 and drove 10000 miles. If you have a W-2 job. Amazon Flex will not withhold income tax or file my taxes for me.

Most drivers earn 18-25 an hour. Having more money in your pocket. If you dont have other tax withholding that covers your tax liability you will need to make quarterly tax payments.

Turn cookies on or off - Computer - Google Account Help.

Democrats Divided Over Tax Proposals To Pay For Budget Bill The New York Times

![]()

Amazon 3000 Sign On Bonus Everything You Need To Know Warehouse Ninja

International Amazon Fba Sellers Guide To Getting U S Sales Tax Compliant Taxjar

/cdn.vox-cdn.com/uploads/chorus_asset/file/13651084/GettyImages_875858764.jpg)

Long Hours No Benefits What It S Like To Be An Amazon Flex Driver Vox

Guide To Filing Tax Returns For Delivery Drivers In 2022

Apply For Amazon Flex Requirements Driver Sign Up Process Ridester Com

Does Amazon Flex Take Out Taxes In 2022 Tax Forms Explained

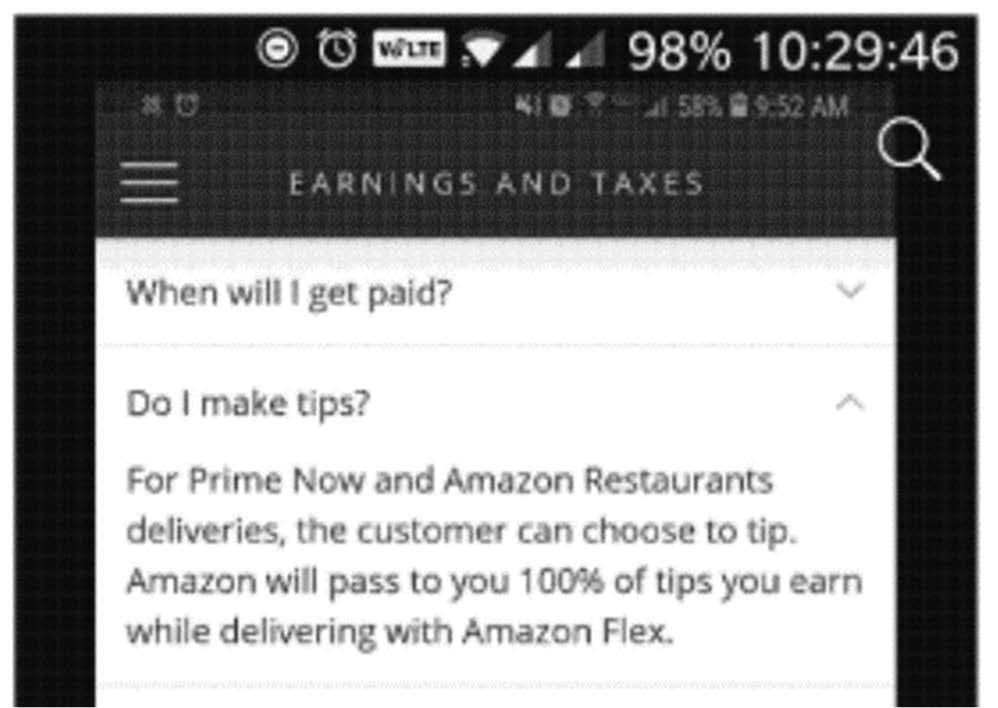

Amazon To Pay 61 7 Million To Settle Ftc Charges It Withheld Some Customer Tips From Amazon Flex Drivers Federal Trade Commission

The Ethical Issues With Amazon Ethical Unicorn

Amazon Flex Tax Write Off Tiktok Search

Amazon Flex Tax Forms Info On Income Tax For Amazon Flex Drivers

Amazon Flex Mileage Tracking Explained Triplog

Gas Tax Cuts Reward The Wrong Drivers Reuters

Become An Amazon Flex Driver To Earn Cash Small Business Trends

Amazon Seller Income Tax And Sales Tax Reporting The Ultimate Guide

How To Manage Your Amazon Flex Income And Taxes With Accountable Accountable